Startup Solution Store | Tax planning

Tax planning can be daunting for startups facing uncertainty, limited resources and complex tax laws. Stay ahead of the game with our EY expert guidance on tax strategies tailored to your startups unique needs. From compliance to identifying tax saving opportunities, our experienced team can help you optimise your financial management for success.

Do you have any questions?

Get in touch.

Challenges for startups

Tax planning is a critical aspect of any startup's financial management, and there are several challenges that startups may face when it comes to tax planning, including:

Uncertainty: Startups often operate in a rapidly changing business environment, which can make it difficult to predict future revenues and expenses. This uncertainty can make it challenging to develop a comprehensive tax planning strategy.

Limited Resources: Startups typically have limited resources and may not have the budget to hire a dedicated tax professional or invest in expensive tax planning software.

Complexity: The tax code is complex and can be difficult to navigate, particularly for startups that are not familiar with tax laws and regulations. This complexity can make it challenging to identify tax-saving opportunities or develop tax-efficient strategies.

Compliance: Startups must comply with all applicable tax laws and regulations, which can be time-consuming and expensive. Failure to comply with tax laws can result in penalties and fines.

Changing Tax Laws: Tax laws and regulations are subject to change, and startups must stay up-to-date with these changes to ensure that their tax planning strategies remain effective.

Limited Time: Startups are often focused on growing their business and may not have the time or resources to dedicate to tax planning.

Do not let tax planning overwhelm your startup - contact us now for professional solutions to your tax challenges.

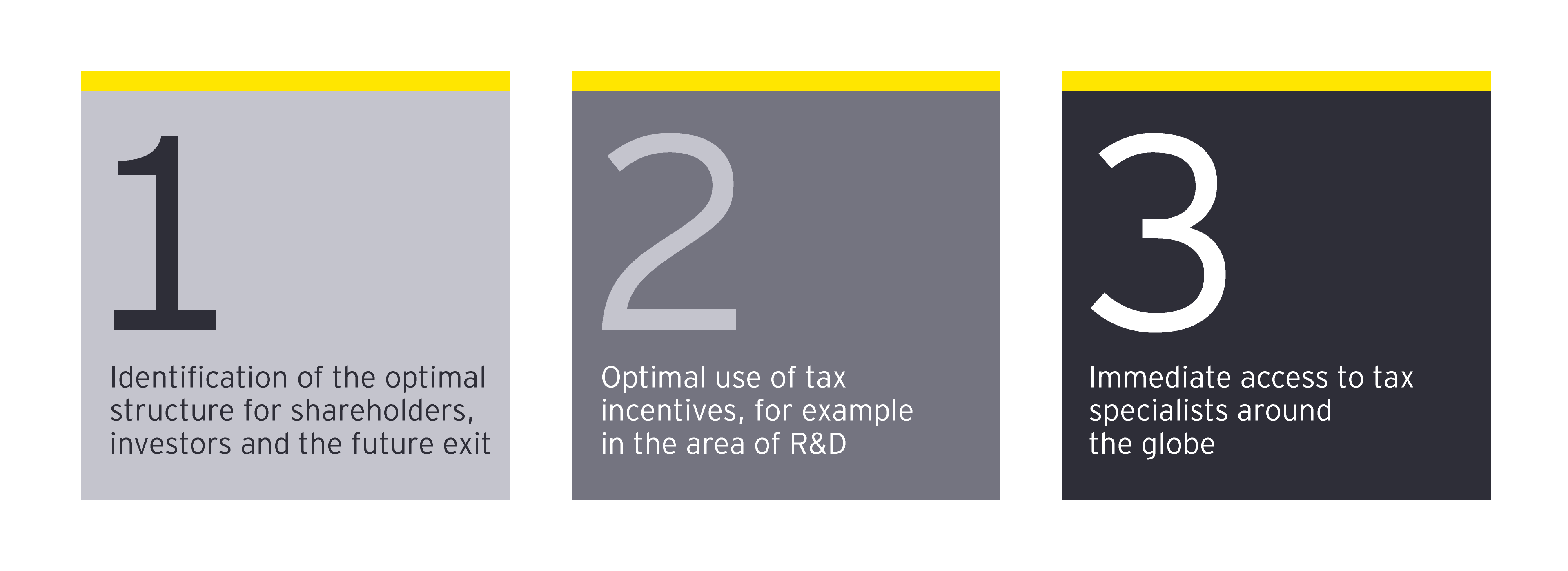

Three advantages

During the startup phase of a venture, decisive decisions are made which impact future tax implications, be it with regard to investors, financing rounds or a future exit.