Startup Solution Store | Seed Equity Financing Round

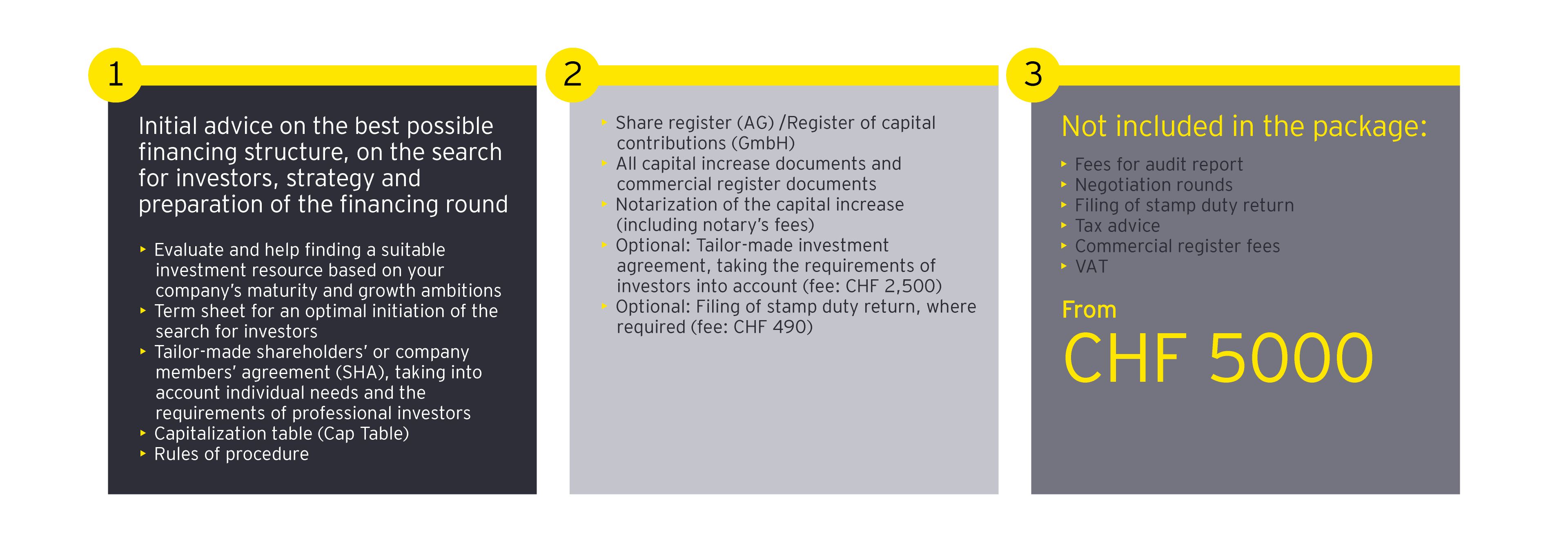

Initial advice on the best possible financing structure, on the search for investors, strategy and preparation of the financing round.

Do you have any questions?

Get in touch.

Challenges for startups

Startups face several challenges when determining the best possible financing structure. Here are some of the most common challenges:

Limited resources: Startups often have limited resources, including time, money, and personnel, which can make it difficult to research and evaluate various financing options.

Lack of experience: Startups may lack experience in structuring financing rounds and negotiating with investors, which can make it challenging to determine the best possible financing structure.

Balancing ownership and control: Startups must balance ownership and control when structuring financing rounds. Giving up too much equity can dilute the founders' ownership stake and control over the company, while not offering enough equity may make it difficult to attract investors.

Debt vs. equity: Startups must determine whether to raise funds through debt (e.g., loans) or equity (e.g., selling ownership stake in the company). Both options have advantages and disadvantages, and startups must evaluate which option best meets their needs.

Valuation: Startups must determine their company's valuation, which can be challenging for early-stage companies with limited financial history and revenue.

Investor expectations: Startups must consider investor expectations when structuring financing rounds. For example, if investors expect a high return on their investment, the startup may need to prioritize growth over profitability, which can impact the financing structure.

Legal and regulatory compliance: Startups must comply with various legal and regulatory requirements when structuring financing rounds, such as securities laws and tax laws. Failure to comply can result in legal issues and financial penalties.