Startup Solution Store | Ongoing tax compliance

Tax compliance can be overwhelming for startups dealing with limited resources, complex tax laws and multiple jurisdictions. Let our team of experts guide you through the challenges of tax compliance, from understanding tax laws to accurate reporting and keeping up with changes. Do not risk penalties and fines - ensure the success of your business with our tailored tax compliance solutions.

Do you have any questions?

Get in touch.

Challenges for startups

Tax compliance can be a significant challenge for startups, particularly as they navigate the early stages of their business. Some of the challenges include:

Understanding Tax Laws: entrepreneurs may lack experience in dealing with tax laws and regulations, making it difficult for them to understand their tax obligations.

Limited Resources: Startups often operate on a tight budget, making it challenging to allocate the necessary resources to ensure tax compliance. This may include hiring tax experts or investing in software and systems to manage tax obligations.

Tax Reporting: Startups may struggle with tax reporting requirements, including filing accurate tax returns and providing timely information to tax authorities.

Compliance with Multiple Tax Jurisdictions: Startups that operate in multiple tax jurisdictions may find it challenging to comply with the different tax laws and regulations in each region.

Keeping up with Changes in Tax Laws: Tax laws and regulations are subject to change, and startups may find it difficult to keep up with the latest requirements.

Penalties and Fines: Failure to comply with tax laws and regulations can result in significant penalties and fines, which can be particularly challenging for startups operating on limited budgets.

Overall, startups must prioritize tax compliance to avoid penalties, protect their reputation, and ensure the long-term success of their business. Contact us now for expert guidance to overcome tax compliance challenges and pave the way for your business to grow.

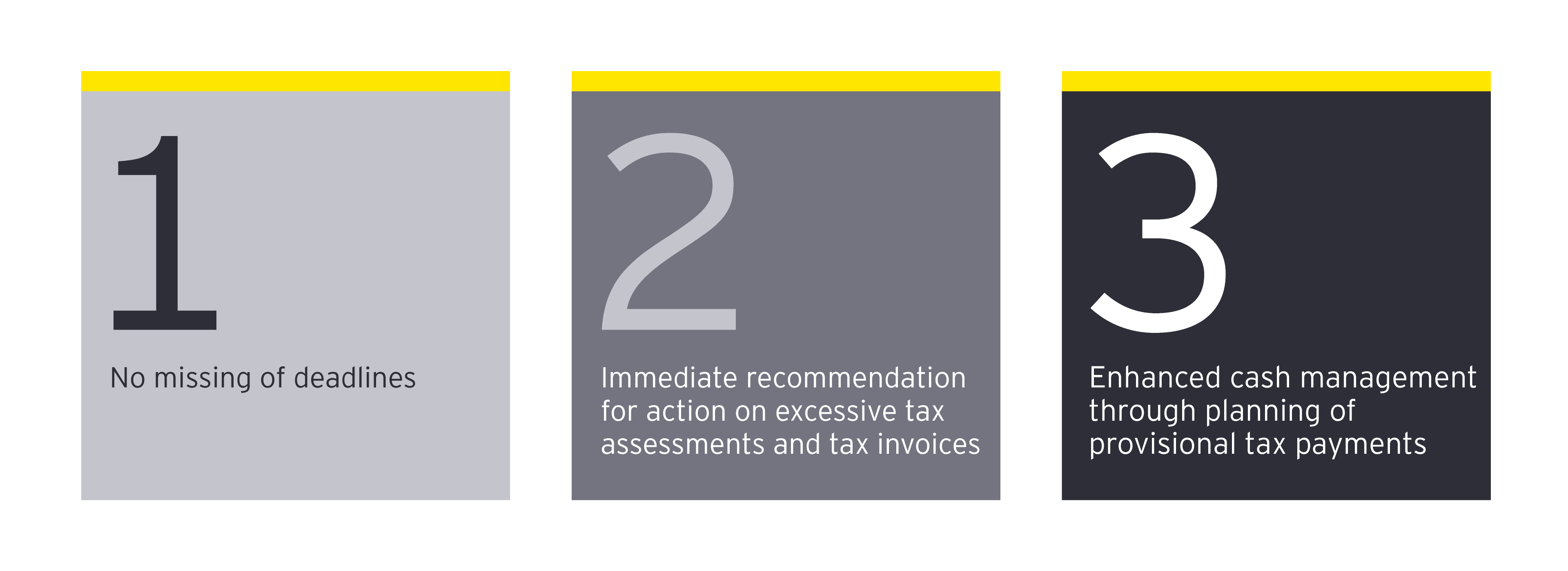

Three advantages

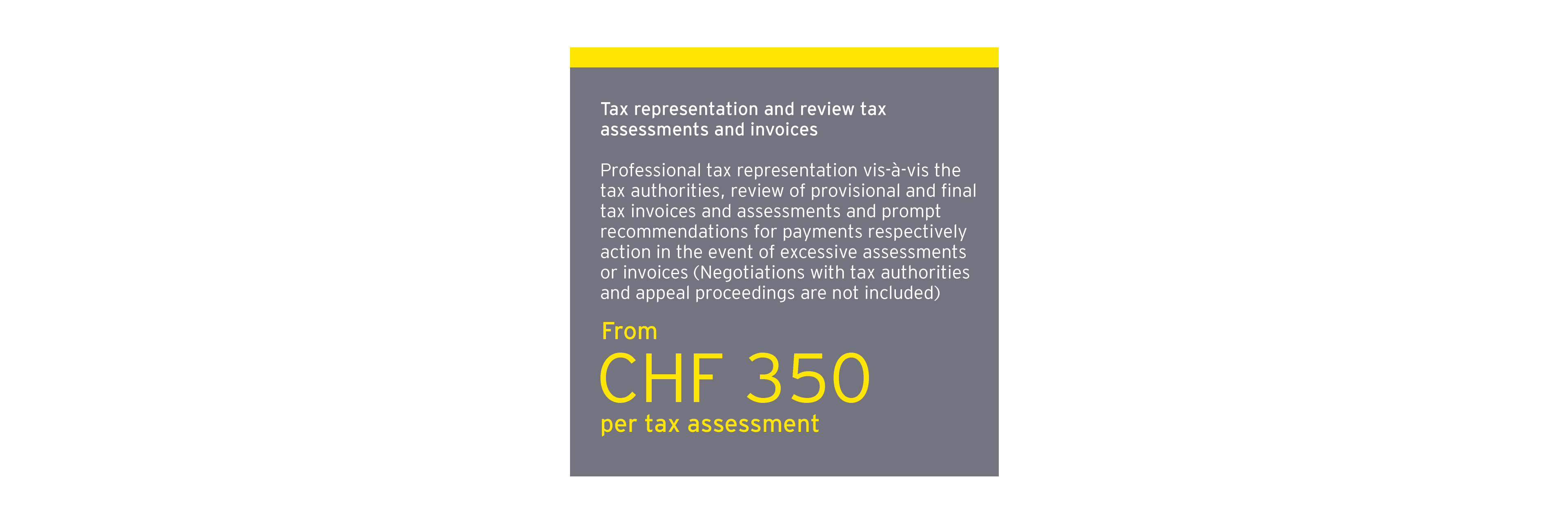

Cash management, which is particularly important for startups, can be positively impacted by planning provisional tax payments.